- Do you struggle with how to assess redlining risk for your company?

- Did you know there are multiple ways to analyze redlining?

- Do you know how policies impact redlining outcomes?

- Did you know that redlining analysis can go back several years?

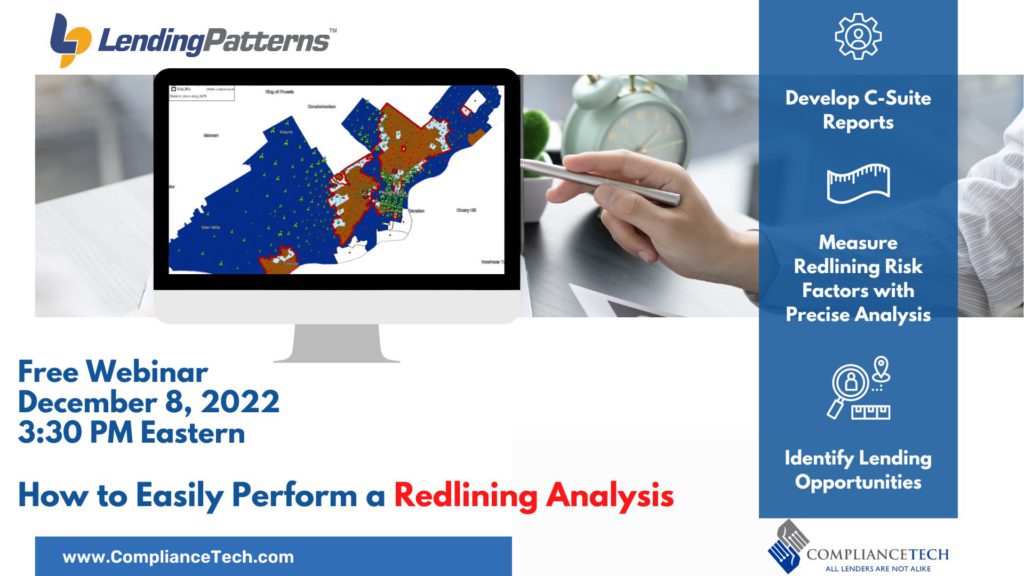

With ComplianceTech’s proven software, LendingPatterns™, you can easily monitor potential redlining risks. Here are some key recommendations to avoid investigations and penalties:

- Compare the share of lending in White majority tracts to majority-minority tracts and test differences for statistical significance using refined peer groups.

- If differences exist, determine the magnitude of any market penetration issue by computing the number of applications needed in impacted geographies to eliminate risk.

- This practical takeaway helps lenders like yourself develop strategic marketing plans and loan production targets.

- Our software allows you to easily create peer groups based on known competitors with a similar activity range, asset size, regulator/type of institution, and business models.

- And you can even investigate market penetration using multiple testing methodologies used by federal and state examiners.

ComplianceTech, founded in 1992, provides fair lending web-based solutions and consulting services. Our industry-leading Suite for mortgage, consumer, and small business lending includes LendingPatterns™, Fair Lending Magic™, HMDA Ready™, CRA Check™, and Fair Servicing™. We are committed to offering free, fair lending webinars throughout the year.

Access the Recorded Presentation

Recent Comments