For banks who need to prepare, submit, and report a CRA loan application register (LAR) and prepare for CRA exams.

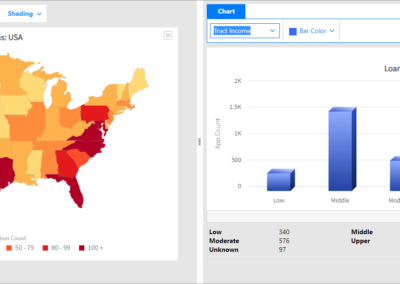

What CRA Check™ does for you

1. Minimize the risk of an unsatisfactory CRA Rating

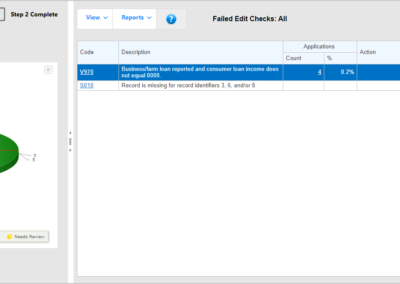

2. Mitigate Compliance Management System (CMS) Risk by building a better CRA data foundation

3. Identifies hidden data quality problems undetected by edit checks

4. Establishes the foundation for accurate and effective CRA Compliance and a positive CRA examination experience

5. Identify numeric outliers that fall outside user-specified standard ranges

6. No software to install, update or maintain by your firm

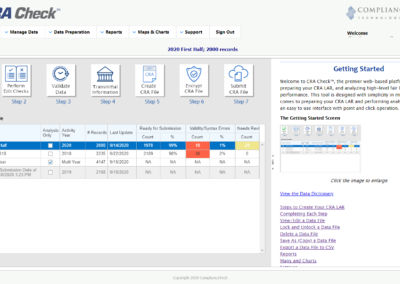

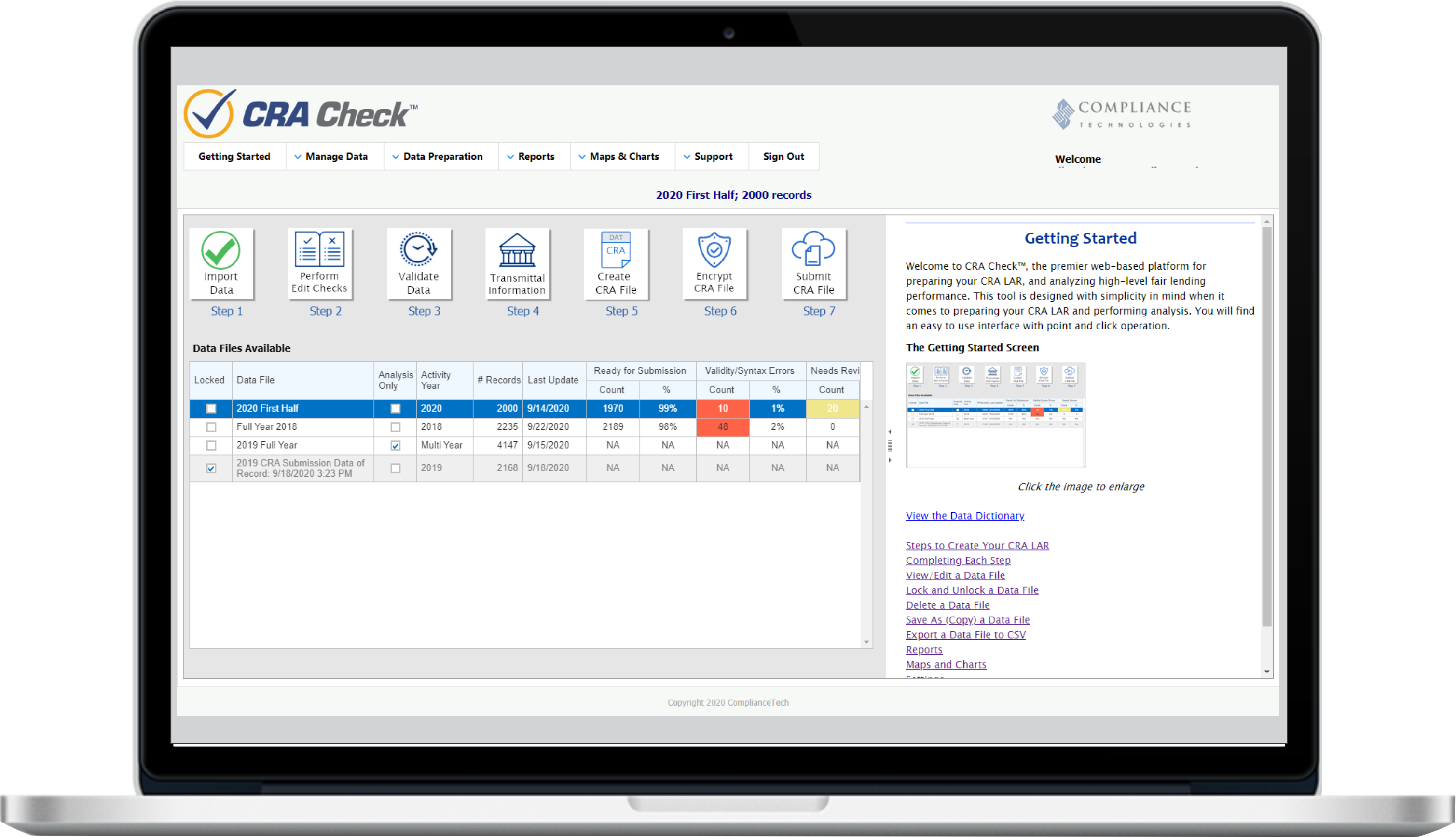

Step-by-Step guided process to create CRA data file for submission

- Fully integrated with other ComplianceTech tools, (Fair Lending Magic™, Lending Patterns™, and HMDA Ready™)

Includes standard and peer- based core tables

1. Better data quality improves managerial decision-making

2. Generate submission-ready loan application register databases from scratch using our spreadsheet template or via import from a loan origination system or other vendors’ application

On-screen help

1. Expert training and support

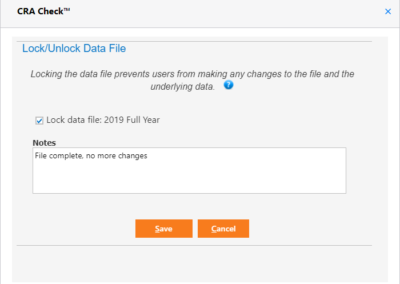

2. Allows limited access for others to help prepare the CRA data for submission

3. Delegate tasks to other members of your team through administrator permissions