As a mortgage compliance professional, you know your fair lending responsibility related to HMDA; but I want to go beyond and discuss how to use HMDA data for strategic planning. If you are concerned with corporate growth and development, then you know this is more than a check-the-box exercise. Done with attention and thought, the output can identify new opportunities and provide goal development, an understanding of strengths and weaknesses, and a feedback loop for future planning. A systematic approach begins with defining financial loan production objectives related to origination volumes, sources of origination, mortgage product types, and market penetration.

But wait…don’t set your loan production objectives without first conducting an in-depth evaluation of the competitive market factors using HMDA data. Pay specific attention to insightful data sets, such as historical market size and forecasted growth, product line breakdown, benchmarks, and organizational and demographics analysis.

As an example, let’s start with some questions regarding the competitive landscape. Answering these questions will enable you to assess market penetration to determine where you are, followed by, where you want to be. This list is not meant to be totally inclusive but provide a good starting point.

Competitive Landscape Assessment to Assess External Factors that may have an Impact on the business:

Who are my Competitors by Market Area?

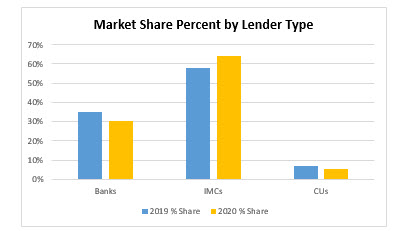

- Lending Institutions (participants, market share, their size, type, and interaction with the secondary market)

- Evaluate change in market competitors (new vs. shrinking)

- Classify competitors as direct and indirect

- What changes in the competitive services in a market have affected or could affect market share (new branch locations, new players, loan pricing, NIV, etc.)?

- Assess competitors’ lending strengths and weaknesses (rank by origination, denial, and fallout rate; community lending gaps; population penetration, etc.)

Describe the Products and Diversification by Market Area

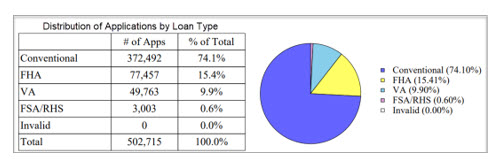

- What is the concentration of loans by volume, type, purpose, etc.?

- What products offered by competition do we not offer?

- Distinguish between investment quality loans and higher risk loans

Strategic planning is a coordinated effort among all functional areas. Done right, you can assure that the rewards outweigh the risks and uncertainties. Completing the competitive landscape assessment will enable you to determine your competitive advantage that can be exploited to produce more loans.

Case Study Results based on 2020 HMDA data:

Using LendingPatterns™ I ran selected ranking, market share and demographic reports to assess the size and competitive profile of Atlanta-Sandy Springs-Roswell MSA

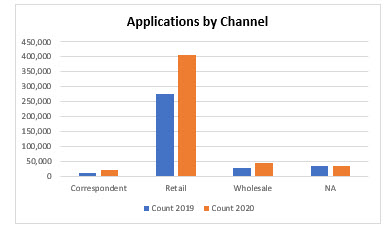

- Change in volume (originated loans): 54.0% increase between years 2019-2020

- Participating lenders: 945 lenders in 2019 / 986 lenders in 2020; a 4.34% increase

- Loan Demand based on applications: 40.3% of housing stock

We can help you monitor and evaluate your fair lending risks. The ComplianceTech Suite of popular fair lending software products include:

- LendingPatterns™: Comprehensive HMDA analysis

- Fair Lending Magic™: Automates compliance and fair lending risk analysis for all types of loans

- CRA Check™: CRA LAR prep/submission; exam preparedness; and includes core reports

- HMDA Ready™: HMDA LAR prep with national benchmarking

- Fair Servicing™: Analyze loan default and loss mitigation process by prohibited basis groups

- Fair Lending Consulting: Comprehensive fair lending assessment services

If you’re not sure which fair lending software suits your organization’s needs best — or whether you need more than one solution — request a demo so you can experience the features that come with each option.

Recent Comments