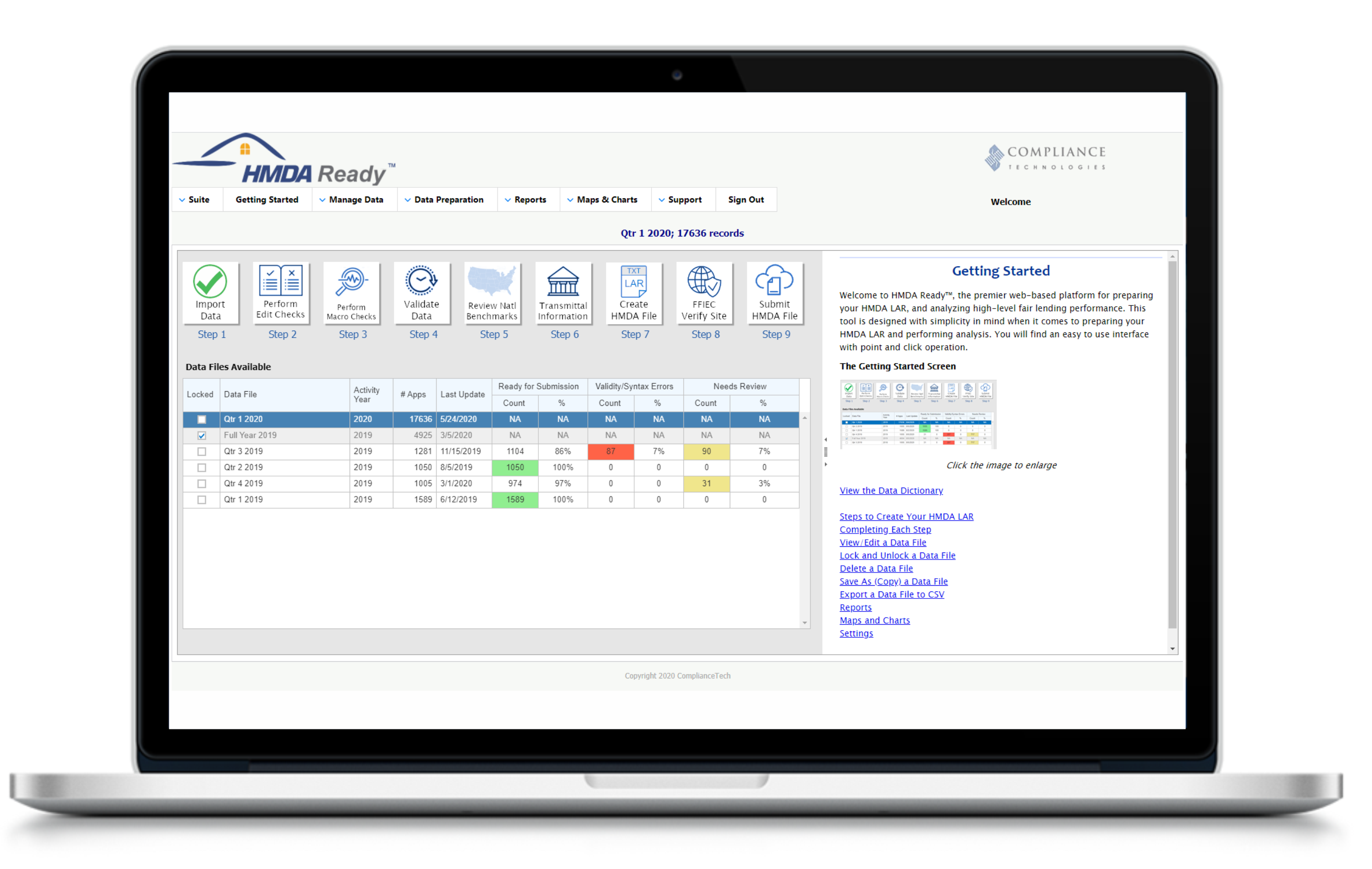

For mortgage lenders who want to have confidence in their HMDA loan / application register (LAR) submission

What can HMDA Ready™ do for you?

What HMDA Ready™ does for you

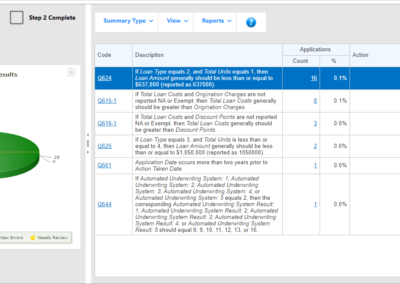

- Avoid civil monetary penalties, costly resubmission expenses.

- Mitigate Compliance Management System (CMS) Risk by building a better HMDA data foundation.

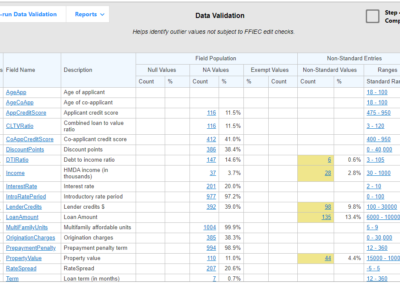

- Identifies hidden data quality problems undetected by edit check.

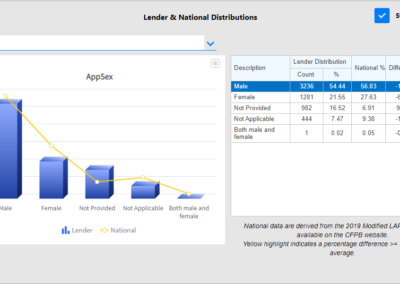

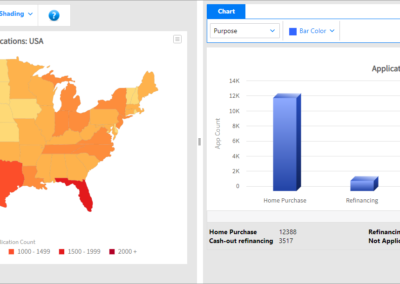

- Establishes the foundation for accurate and effective fair lending monitoring.

- Critical for a superior fair lending examination experience by your federal or state examining authority.

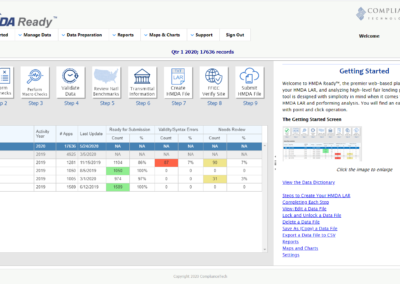

Step-by-Step guided process

- Fully integrated with other ComplianceTech tools, (Fair Lending Magic™, Lending Patterns™, HMDA Ready™, and CRA Check™)

- Free upgrade for existing LP or FLM customers

Data Validation, Reports and Features

- Better data quality improves managerial decision-making Generate submission-ready loan application register databases from scratch using our spreadsheet template or via import from a loan origination system or other vendors’ application.

- On-screen HMDA Guidance

- User Permissions

- National Benchmarking