In my previous blog, I wrote about the drivers of Fannie Mae’s increased purchasing activity. This blog will explore the extent to which that growth was driven by declining interest rates.

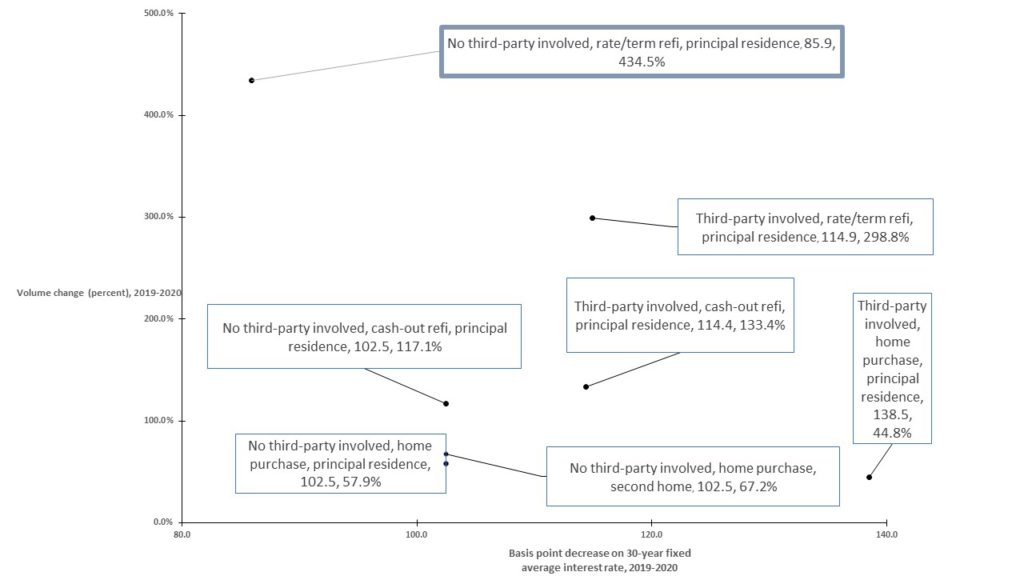

I want to show a chart that distinguishes transactions based on whether the HMDA-reporting institution is doing business with a third party, but first want to define a couple terms:

- No third party involved indicates an application that was submitted to and initially payable to the HMDA reporter.

- Third party involved means that the application was submitted to and/or initially payable to a third-party entity which is not the HMDA-reporting institution.

The reasons for bifurcating the market are: 1) lenders often cite third-party relationships as an explanation for differences in loan costs that consumers pay, and 2) consumers like to keep track of whether getting a loan through a third party will generally result in more favorable loan terms.

The figure below includes only conventional, conforming, consumer-purpose, 1st lien, 1-4 family originations that were purchased by Fannie Mae. The seven transaction types that are described together account for 89.2% of Fannie Mae’s 2020 purchases of loans that were originated by HMDA reporters (3.30 million of 3.69 million).

The figure shows on the x-axis a decrease in average interest rates on 30-year fixed-rate loans, and on the y-axis you can see the corresponding percent increase in unit loan volume in 2020.

Figure 1: Volume change by average 30-year fixed interest rate decrease, 2019-2020, for select transaction types.

Note that a 100% increase indicates a doubling of purchases. For example, the uppermost point, which is next to a thick blue box, indicates that for principal residence rate/term refinancings with no third party involved, there was an 85.9 basis point drop between 2019 and 2020, and the loan volume increased by 434.5%, meaning more than a five-fold increase.

As I wrote in my previous blog, all of this information is available at your fingertips with LendingPatterns™. This should make clear that LendingPatterns™ is a powerful and robust tool. Regardless of the size of the 2020 dataset, LendingPatterns™ gives you the ability to quickly summarize large quantities of data, as well as the filters to help you make sense of the data.

If you have questions about how to use the tool, please don’t hesitate to reach out to us at www.Compliancetech.com or by phone at 202-842-3800.

Recent Comments