The Consumer Financial Protection Bureau (CFPB) recently introduced a new rule regulating small business lending practices. The rule addresses concerns over predatory lending and ensures that small businesses have access to fair and transparent financing options. This blog post will discuss the critical elements of the new small business lending rule and what it means for small business owners.

Background on the Small Business Lending Rule

Before we dive into the details of the new rule, it’s essential to understand why it was created. The CFPB has identified several issues with the current small business lending market, including a lack of transparency, discrimination, and unfair lending practices. Historically, small businesses have been underserved by traditional lenders, leading to a proliferation of alternative lenders that may not have the same regulatory oversight as traditional banks. These lenders may charge high-interest rates, require unfair repayment terms, and engage in other predatory practices that can harm small business owners.

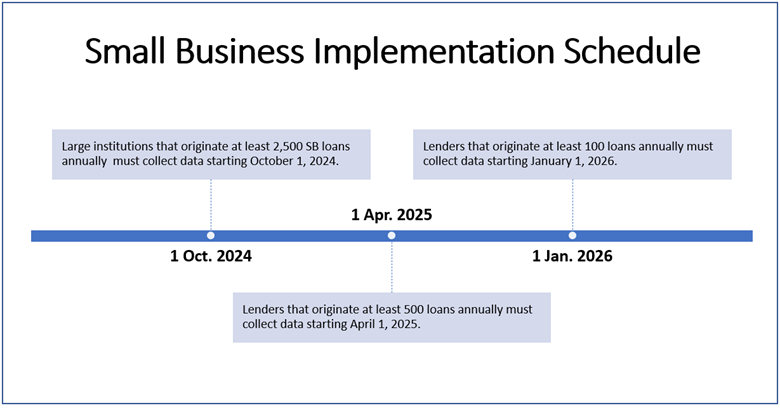

The final rule has changed from the proposal issued in September 2021, reflecting more than 2,100 public comments and extensive public input. Data collection and reporting will be phased in based on the number of small business loans originated annually.

Key Elements of the Small Business Lending Rule

The new small business lending rule has several key elements designed to protect small businesses and ensure access to fair and transparent financing options. Let’s take a closer look at each of these elements:

- Application: Loan officers will no longer be required to determine an applicant’s race or ethnicity, as small businesses can self-identify as women-, minority-, or LGBTQI+-owned.

- Coverage: The rule applies to lenders that offer small business loans, lines of credit, or merchant cash advances, regardless of whether the lender is a bank or an alternative lender.

- Disclosure: Lenders are required to provide clear and concise disclosures to small business borrowers, including the total cost of the loan, the annual percentage rate (APR), and all fees associated with the loan.

- Underwriting: Lenders must use a “prudent person” standard when evaluating small business loan applications, meaning that they must ensure that the borrower has the ability to repay the loan based on their financial circumstances.

- Prohibition of Discrimination: Lenders are prohibited from discriminating against small businesses based on race, sex, religion, or other protected classes.

- Record-Keeping: Lenders must maintain records of their small business lending practices, including information on loan applications, loan approvals and denials, and the race and gender of the small business owner.

Implications for Small Business Owners

The new small business lending rule has several implications for small business owners:

- It provides greater transparency into the true cost of small business loans, allowing small business owners to make more informed decisions about their financing options.

- It ensures that small businesses are not unfairly discriminated against when applying for loans.

- It provides greater regulatory oversight of the small business lending market, which may help to reduce predatory lending practices.

Small Business Lending Resources

The Consumer Financial Protection Bureau released its Small Business Lending Rule: Small Entity Compliance Guide in May 2023. This resource is valuable for lenders preparing for Small Business lending data collection and reporting.

The final rule is available on the CFPB’s website.

ComplianceTech Can Help Lenders Comply with Small Business Lending Rule

If you are a financial institution or lender looking for guidance and support in complying with Section 1071 of the Dodd-Frank Act related to small business lending reporting and collection, look no further than ComplianceTech. Our team of experts has been at the forefront of financial compliance for over 30 years and can help you navigate the complexities of this new regulation.

Keep the compliance burden of Section 1071 from weighing you down. Contact us today to learn more about our comprehensive suite of compliance solutions and how we can help you stay ahead of the curve. Our team is dedicated to providing the guidance and support you need to navigate the ever-changing regulatory landscape and remain compliant with all relevant laws and regulations.

We can ensure that your lending practices are fair and equitable while meeting your compliance obligations. Contact ComplianceTech today to get started and learn more about our Small Business Lending web-based software.

Recent Comments