The 2023 Modified HMDA LARs have been unveiled, offering a sneak peek into last year’s mortgage market’s performance. While it’s no secret that mortgage lending took a nosedive compared to the red-hot 2021, let’s dive into the nitty-gritty details using the powerful LendingPatterns™ HMDA analysis software and see what insights we can uncover.

The Big Picture: Lending Volumes Plummet

Excluding commercial and investment properties, the total dollar amount of originated loans and lines of credit plunged a staggering 65.5%, from a soaring $4.154 trillion in 2021 to a mere $1.433 trillion in 2023. Brace yourselves, folks, because these numbers are not for the faint of heart.

The Bread and Butter: Home Purchase Loans

Now, let’s zoom in on the bread and butter of the mortgage world: consumer-purpose, closed-end, 1st lien, 1-4 family, 1st and 2nd residence, home purchase loans. Here, the dollar volume dropped by a considerable 34.1%, from $1.629 trillion in 2021 to $1.072 trillion in 2023.

However, as conforming loan limits have increased, the average loan amount on these loans has risen from $357,080 to $380,230, while the average interest rate has skyrocketed from a measly 3.058% to a whopping 6.537%. Additionally, the number of these transactions has taken a 38.1% nosedive, plummeting from 4.56 million to 2.82 million.

The Shifting Landscape: Product Composition

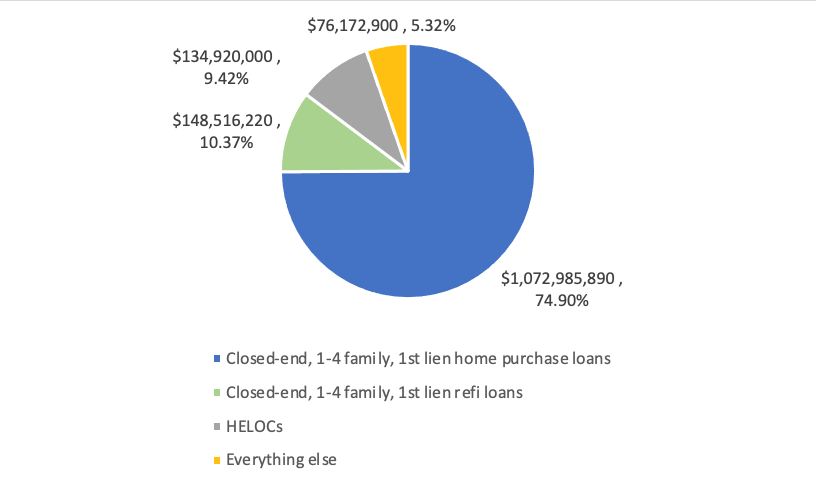

Interestingly, this type of home purchase lending accounted for just 39.2% of the $4.154 trillion lent in 2021 but ballooned to a substantial 74.9% of the $1.433 trillion lent in 2023. On the other hand, HELOC lending and closed-end 1st lien refinancing have become mere shadows of their former selves, each clinging to a 9-10% share of the market.

Even smaller players, such as 2nd lien closed-end loans, closed-end “other” purpose loans (a.k.a. home equity loans), manufactured housing loans, and closed-end home improvement loans, are now mere slivers of the overall lending pie.

The Lending Pie in 2023

Figure 1. Originated mortgage loan volumes by product, 2023, in thousands of dollars.

Note: commercial and investment loans are excluded

As you ponder these figures uncovered through LendingPatterns’ powerful analysis capabilities, consider how your institution stacks up against the market and which products might be drawing the watchful eye of regulators. The mortgage landscape is ever-shifting, and staying ahead of the curve is crucial.

Contact us today to learn more.

Recent Comments