Defining HMDA peer groups is critical for fair lending benchmark performance evaluation. I’m often asked, “How do regulators define a peer group?” Regulators don’t define peer groups; they offer guidance. For example, they expect lenders to know who their competitors are in their primary lending areas. See below for links to CFPB and FRB guidance. *

In this blog, I would like to share a deliberate and thoughtful approach to creating a custom peer group. First and foremost, lenders should define custom peer groups for each primary lending area, state, MSA, AA, and REMA. The top large lenders can build a national peer group. However, individual peer groups by target area of focus is a better practice for small- to mid-size lenders. This is because each area of focus will have different participating lenders, all with unique business models and institutional characteristics. And, of course, never use a peer group created using a different HMDA year than is being analyzed. New players enter the market and exit as well.

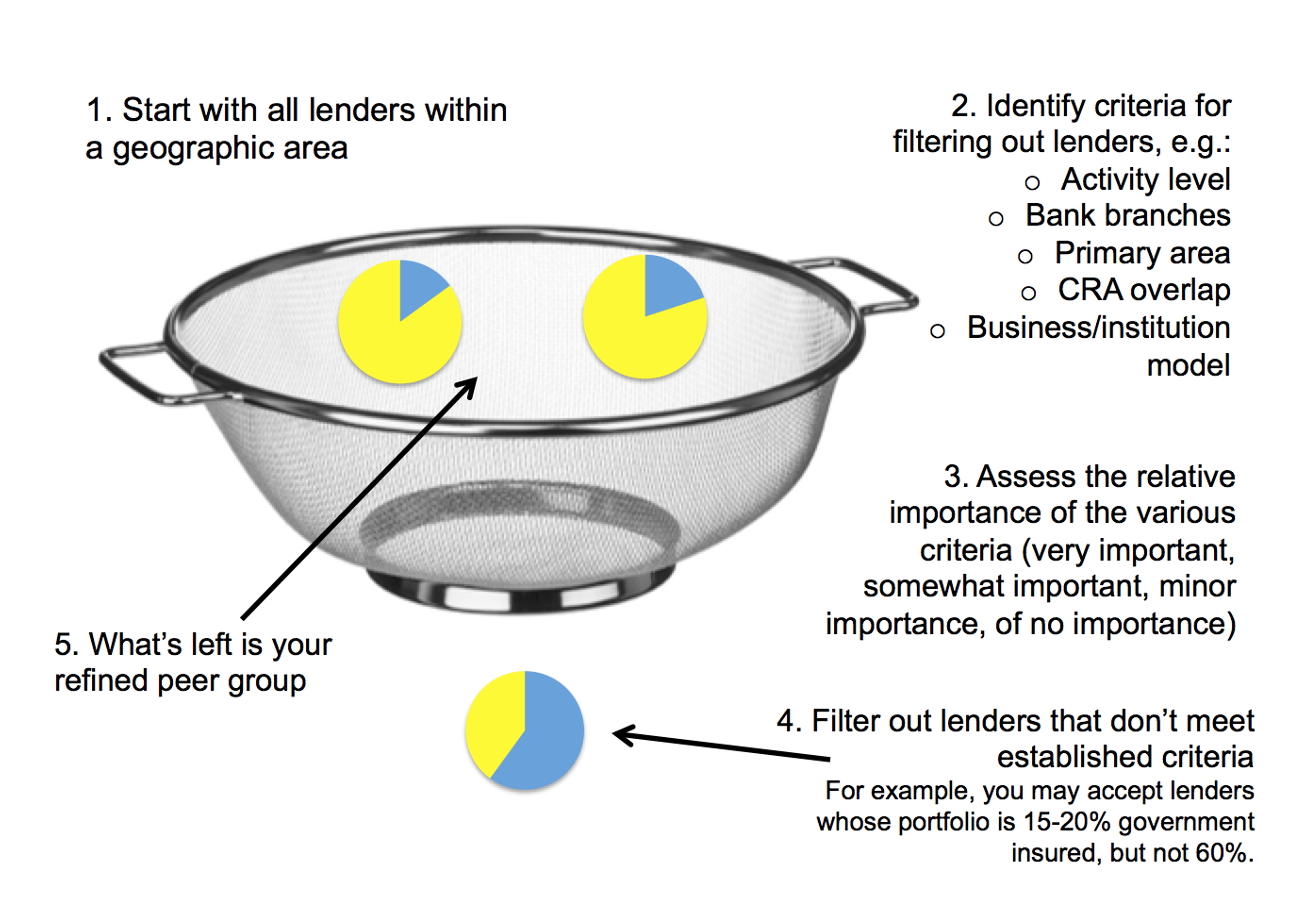

Custom Peer Group Selection Methodology

Start with all lenders in an area, then cut out the outliers. Fortunately, I use LendingPatterns™, which has a built-in robust peer selection tool. It’s easy to apply filters; there is no limit on the number of peers that can be included in a refined peer list. Recommended filters to use to refine your peer lists are as follows:

1. Similar activity level (applications or originations)

2. Include lenders with a bank branch in the target area

3. Include lenders whose primary area is the target area

4. Include lenders who are CRA reporters with overlapping Assessment Areas in the target area

5. Similar business model characteristics (product menu offerings, spread percent, purchased loans program, loan purpose, occupancy, etc.)

6. Similar institutional characteristics (regulator, asset size, overall LAR count, etc.)

Document your peer selection criteria

Document your peer selection criteria: who was included, why, and who was excluded. You must tell your story and present your results based on your definition of peers. You have more significant issues if your regulator can define your peers and you cannot. Lastly, use your internal resources. Loan officers and the production team know who they compete with for applicants. They remember every competing firm they lost business to. Ask your loan originators whose rates are lower and which firms have good company reputations. Be sure these lenders are included in your custom peer lists.

Sieve photo source: Amazon UK

* Federal Reserve Board https://consumercomplianceoutlook.org/2013/second-quarter/fair-lending-webinar/

CFPB (the Bureau) https://files.consumerfinance.gov/f/documents/Supervisory_Highlights_Issue_13__Final_10.31.16.pdf

How we can help you

ComplianceTech provides a range of software and consulting options that lenders can use to ensure they comply with federal and state fair lending guidelines. Our popular fair lending software products include:

- LendingPatterns™

- Fair Lending Magic™

- CRA Check™

- HMDA Ready™

- Fair Servicing™

- Fair Lending Consulting™

If you’re not sure which fair lending software suits your organization’s needs best — or whether you need more than one solution — request a demo to experience the features of each option.

Recent Comments