In our blog on February 13th, we discussed the importance of conducting a peer analysis to compare a lender’s performance in the context of other lenders in the same market. This is the only way a given lender’s performance can be said to be above or below expectations. When it comes to fair lending analysis based on peers beyond shared regulator, asset size or application activity ranges (1/2-2 times), the regulators expect lenders to determine their competition in each market.

Who better to know their peers than the lender, right?

Creating peer lists that are most similar to the target lender’s lending profile takes some refinement and judgment.

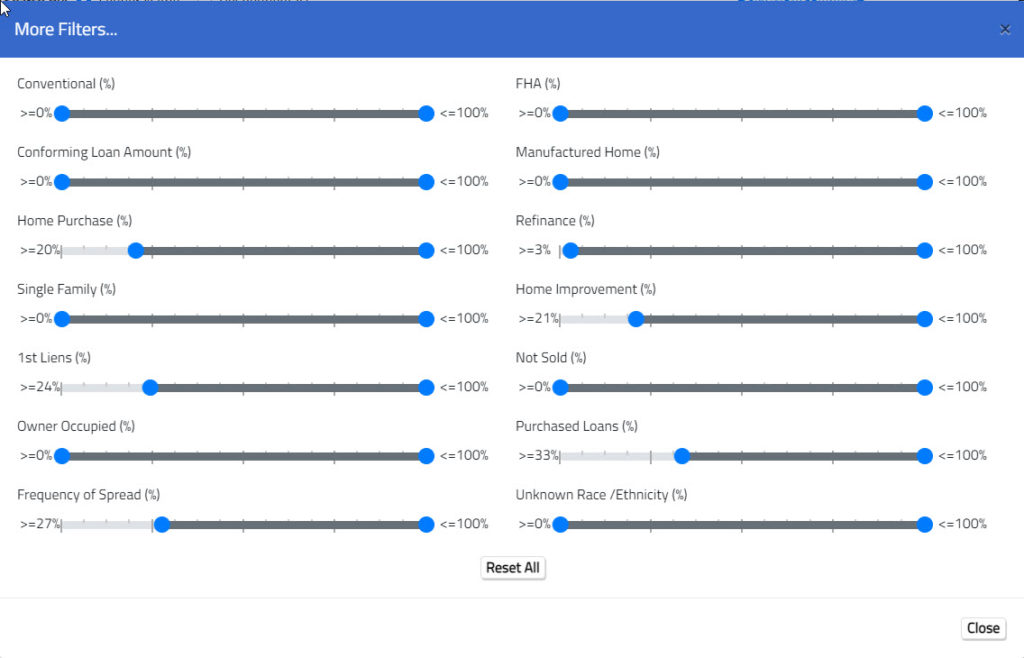

LendingPatterns™ allows us to quickly see the business model for any specific lender in a user defined geography. In the screen below, LendingPatterns™ displays the lender’s activity distribution on a variety of categories such as FHA %, Home Purchase %, Refinance %, Frequency of Spread %, etc. With a better understanding of the target lender’s activity level and business model, the analyst can create a peer list based on the characteristics that are most important to them.

Apples to Apples Peer Selection Advice

· Employ a rational methodology based on lending results

· Match similar focal points based on proportional lending criteria

· Know your business better than your regulator

· Involve multiple functional areas in the process

· Avoid a myopic approach

· Don’t set a minimum or maximum number of peers to be included on a list as these will vary based on the number of lenders in a market, be flexible

· Incorporate a variety of performance metrics

Once a peer list is created, reports can be produced to compare the selected lender to its peers. Peer selection requires more than perfunctory attention. Keep looking ahead to the eventual goal: improving performance with accurate benchmarking.

Recent Comments