This is the second blog in a series about the the 2019 FFIEC census demographic file which was released on August 30, 2019. Into that file FFIEC incorporated September 2018 Office of Management and Budget MSA/Metropolitan Division boundary definitions. As a result there some important changes to tract income categories to be aware of.

Roughly 5.0 million people reside in the 1,190 census tracts where the income category changed in some way. That equates to 1.6% of the US population, including in the 50 states, Puerto Rico, and the District of Columbia. In 2018, there were 193,841 HMDA applications received in these changing geographies, a 1.3% share of the total HMDA application volume.

Of particular importance are the tracts that 1) flipped from moderate to middle income (310 tracts), or 2) flipped from middle income to either low or moderate income (174 tracts). Both sets of tracts account for about 0.2% of the 2018 HMDA application volume.

This blog drills down on the second group of 174 tracts as a potential source of new opportunities to obtain CRA credit for low/mod lending. There were 28,454 HMDA applications in those tracts in 2018. Below is some LendingPatterns(TM) analysis of those applications.

What types of products are consumers applying for in these census tracts? One can use LendingPatterns™ to study the 2018 mortgage market in any set of tracts, in terms of:

Loan type

Loan purpose

Lien status

Owner occupancy

Construction method

Reverse mortgage vs not

Open vs closed end credit

Commercial vs consumer purpose

ARM vs fixed rate loan

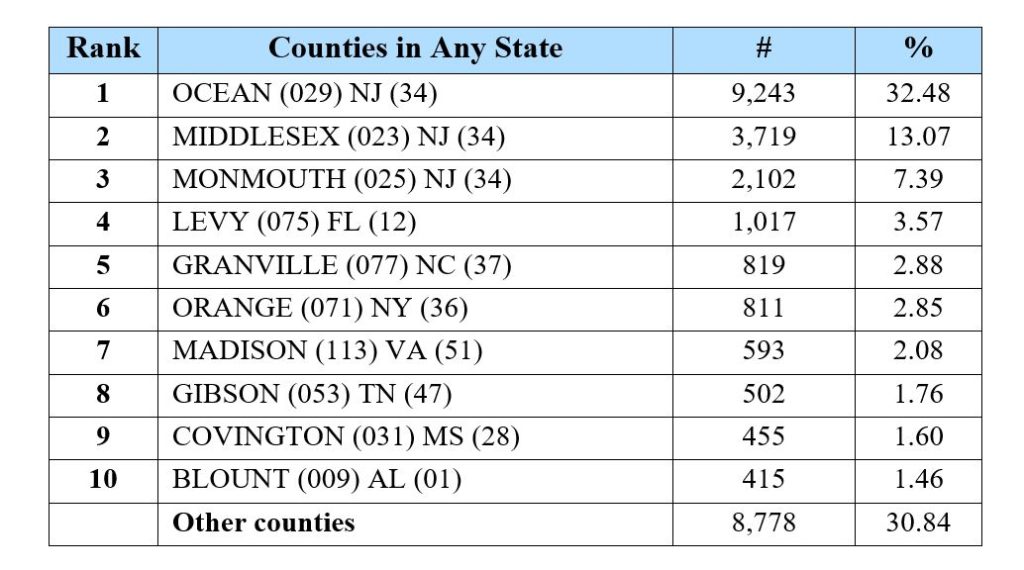

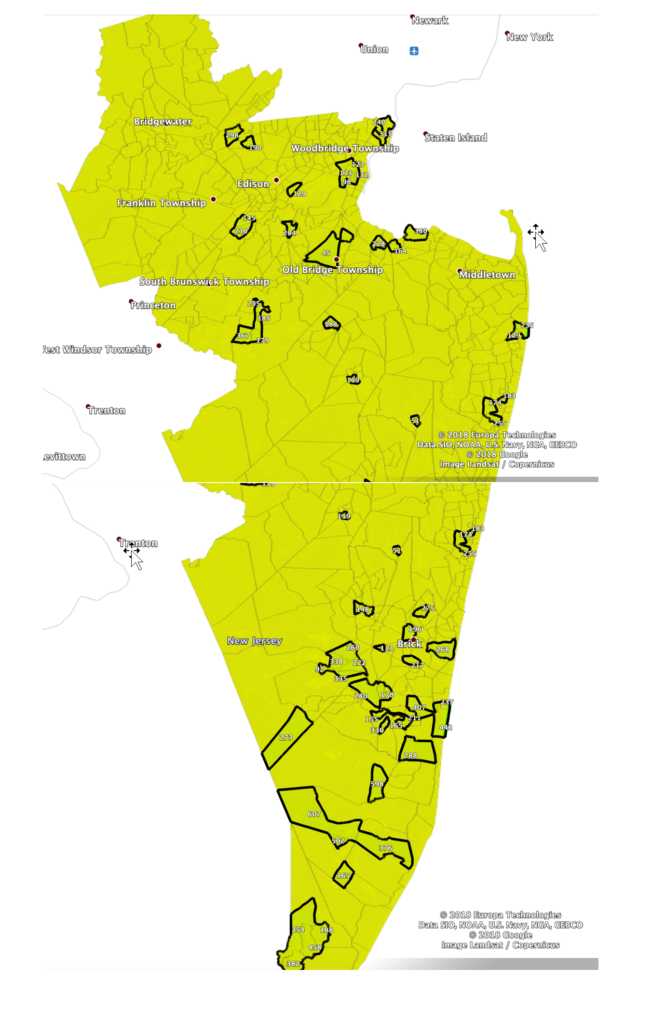

In which counties and metro areas are these applications concentrated? The table below shows the distribution of 2018 applications by county:

Recent Comments