Questionable HMDA annual income values can compromise the integrity of fair lending and Community Reinvestment Act (CRA) analysis. This field seems straightforward, right? The lender reports the “gross annual income relied on in making the credit decision”. The lender should “round all dollar amounts to the nearest thousand”.

The 2020 Filing Instruction Guide (FIG) also provides specific cases when NA is appropriate (the field should never be blank):

- Purchased Loans

- Non-natural person

- Multifamily Affordable Units

- Loan to an Employee

- Credit decision not requiring consideration of income (e.g., streamline refinancings)

The two most common issues with questionable incomes are zeroes and low values (under the level expected to qualify). Interestingly, HMDA rules allow the lender to submit a LAR with any positive/negative number, zero or NA. This latitude opens the door for bad data to slip through edit checks and into your analysis without scrutiny. When it comes time to run matched pairs or underwriting matched pairs this may cause false positives (looks like a fair lending problem but it’s not) or false negatives (is a fair lending problem but looks like it’s not) in your analysis. Moreover, in a CRA or affordable lending context, reporting incomes of less than $10,000, including negative incomes, may have the unintended effect of falsely suggesting an application was made to a low-income family.

CFPB Edit Checks

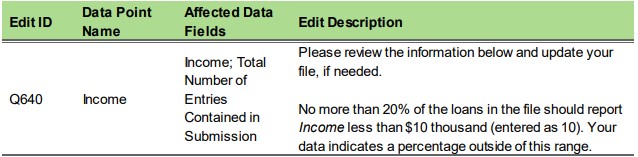

These reporting mistakes may be flagged with the following CFPB quality edit check:

Looking at the national HMDA data, it is apparent that some lenders are struggling with the income reporting issue. Based on the 2019 Snapshot, 315,830 applications have an income of 10 or below (including zeroes and negatives). That represents a 21.1% share of what the CRA and GSEs would classify as “low income” applications. This involved 3,179 lenders (a 57.8% share of the total number of reporters).

So what do you need to do?

- Isolate the questionable annual income values, if any.

- Make sure the values reported have a logical explanation. For example, many of the zero-income values appear to be associated with loan programs that do not require consideration of income, for example, FHA streamlined refinancing.

- Compare the HMDA income value to the product of the monthly underwriting income from LOS multiplied by 12. After rounding, the two numbers should match. If not, you have confirmed a problem that needs research. We are aware of several cases where the lender reported monthly rather than annual incomes.

- Pay attention to the quality edits, in particular Q640. Quality edit issues will not cause your HMDA data to be rejected. However, a smart examiner will focus on such an issue because it reflects on the integrity of your compliance management system.

Implication

Unfortunately, lenders with inaccurate LAR records are getting credit for “low” income lending. A borrower who makes less than 50% of the median income is deemed a low-income borrower in the bank regulators’ Community Reinvestment Act (CRA) regulations (see, for example, the Office of the Comptroller of the Currency regulation).

The underlying principle of fair lending and CRA analysis is peer benchmarking, to see how the subject lender compares to its peers. But what happens when peers aren’t exactly following the HMDA Filing Instruction Guide in their submissions? The consequences could be that the subject lender looks more like an outlier than they really are.

Bottom line, if you think your “low” income results could be artificially lower vis-à-vis peers, you might want to further investigate your peers’ HMDA submission coding. Or reach out to the ComplianceTech team for help. With our LendingPatterns™ software, we can identify these loans by lender in your lending footprint.

Recent Comments