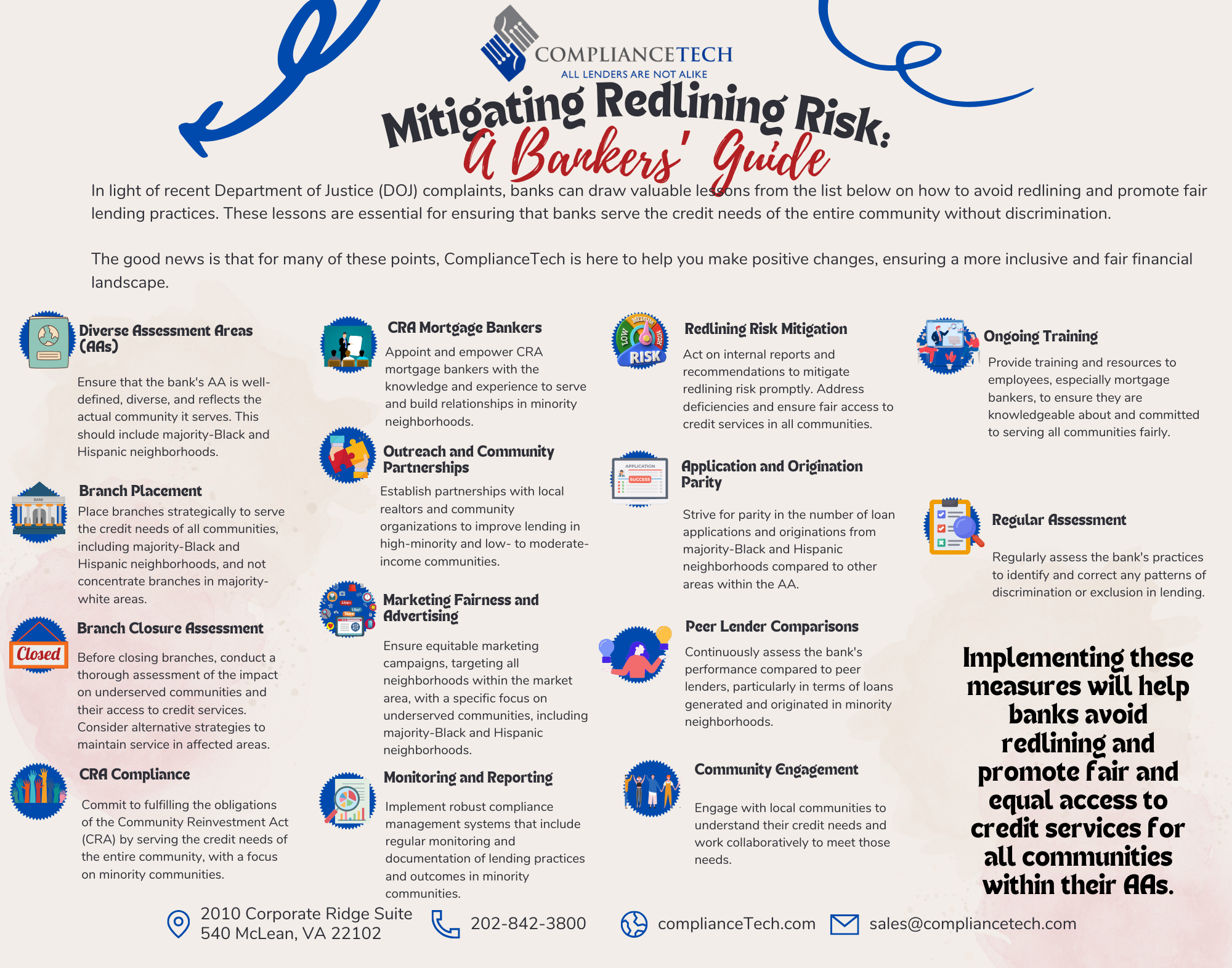

In light of recent Department of Justice (DOJ) complaints, banks can draw valuable lessons from the list below on how to avoid redlining and promote fair lending practices. These lessons are essential for ensuring that banks serve the credit needs of the entire community, without discrimination.

The good news is that for many of these points, ComplianceTech is here to help you make positive changes, ensuring a more inclusive and fair financial landscape.

Elevate Fair Lending with ComplianceTech

- Diverse Assessment Areas (AAs): Ensure that the bank’s AA is well-defined, diverse, and reflects the actual community it serves. This should include majority-Black and Hispanic neighborhoods.

- Branch Placement: Place branches strategically to serve the credit needs of all communities, including majority-Black and Hispanic neighborhoods, and not concentrate branches in majority-white areas.

- Branch Closure Assessment: Before closing branches, conduct a thorough assessment of the impact on underserved communities and their access to credit services. Consider alternative strategies to maintain service in affected areas.

- CRA Compliance: Commit to fulfilling the obligations of the Community Reinvestment Act (CRA) by serving the credit needs of the entire community, with a focus on minority communities.

- CRA Mortgage Bankers: Appoint and empower CRA mortgage bankers with the knowledge and experience to serve and build relationships in minority neighborhoods.

- Outreach and Community Partnerships: Establish partnerships with local realtors and community organizations to improve lending in high-minority and low- to moderate-income communities.

- Marketing Fairness and Advertising: Ensure equitable marketing campaigns, targeting all neighborhoods within the market area, with a specific focus on underserved communities, including majority-Black and Hispanic neighborhoods.

- Monitoring and Reporting: Implement robust compliance management systems that include regular monitoring and documentation of lending practices and outcomes in minority communities.

- Redlining Risk Mitigation: Act on internal reports and recommendations to mitigate redlining risk promptly. Address deficiencies and ensure fair access to credit services in all communities.

- Application and Origination Parity: Strive for parity in the number of loan applications and originations from majority-Black and Hispanic neighborhoods compared to other areas within the AA.

- Peer Lender Comparisons: Continuously assess the bank’s performance compared to peer lenders, particularly in terms of loans generated and originated in minority neighborhoods.

- Community Engagement: Engage with local communities to understand their credit needs and work collaboratively to meet those needs.

- Ongoing Training: Provide training and resources to employees, especially mortgage bankers, to ensure they are knowledgeable about and committed to serving all communities fairly.

- Regular Assessment: Regularly assess the bank’s practices to identify and correct any patterns of discrimination or exclusion in lending.

Implementing these measures will help banks avoid redlining and promote fair and equal access to credit services for all communities within their AAs.

ComplianceTech is a Trusted Fair Lending and Redlining Expert

We are trusted experts in redlining mitigation, equipped to assist you in assessing your risk and providing practical advice tailored to your needs. Request a confidential meeting today with one of our experts.

Download Our Redlining Guide Today

Mitigating Fair Lending Risk: A Banker's Guide

Send download link to:

Recent Comments