The announcement of the merger between Wings Financial Credit Union and ENT Credit Union on April 23, 2025, has prompted me to consider its impact on the industry, as well as what lenders can learn by examining the data behind the merger. The good news is that it is easy to create pseudo bank and credit union mergers using LendingPatterns™, ComplianceTech’s web-based HMDA data analysis tool, which aggregates Home Mortgage Disclosure Act (HMDA) data for all lenders.

2024 HMDA Data Analysis

According to the 2024 HMDA data, Wings Financial Credit Union was lending in 39 states. With the announced merger, the credit union’s footprint will now span 47 states, with the most significant number of applications in Colorado, Minnesota, and Wisconsin. One key area of interest for the banks involved in the merger will be to ascertain the impact of their increased geographic lending footprint.

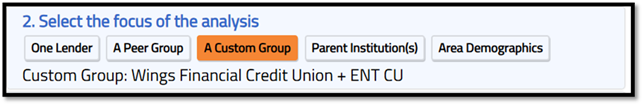

Lenders can combine their data with that of one or more lenders to simulate different scenarios within their lending footprint. This can be done in a matter of seconds, giving lenders a chance to see how their results look before and after a potential merger. It is another way to utilize LendingPatterns™: to strategize and identify business opportunities. This analysis can be conducted for the entire United States or by state, Metropolitan Statistical Area (MSA), County, Census Tract, or congressional district, providing lenders with the opportunity to examine the potential impact in specific target lending areas.

Lenders should evaluate whether they might be taking on too much risk, not only fair lending, but from a safety and soundness perspective. For example, using various risk metrics, such as concentration analysis by product, geography, investment properties, and the percentage of NIV loans, users can make informed decisions before it’s too late. An automated tool that aggregates Home Mortgage Disclosure Act (HMDA) data is the easiest way to mitigate fair lending risks associated with a merger. It is best to stay ahead of the regulators and know your HMDA story.

Custom Peer Groups

With LendingPatterns™, it’s easy to make informed decisions based on real numbers. Remove the guesswork from your strategy. Start using a tool that can help you identify sound market opportunities. You can contact ComplianceTech today to learn how to use LendingPatterns™.

Recent Comments