What can CRA Check™ do for you?

What CRA Check™ does for you

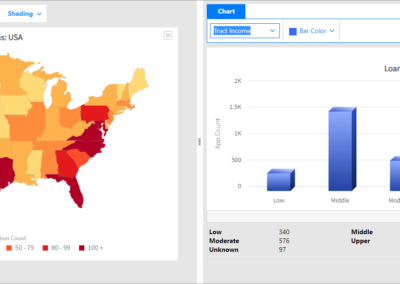

2. Mitigate Compliance Management System (CMS) Risk by building a better HMDA data foundation

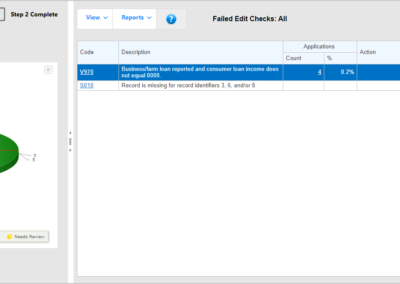

3. Identifies hidden data quality problems undetected by edit checks

4. Establishes the foundation for accurate and effective CRA Compliance and a positive CRA examination experience

5. Identify numeric outliers that fall outside user-specified standard ranges

6. No software to install, update or maintain by your firm

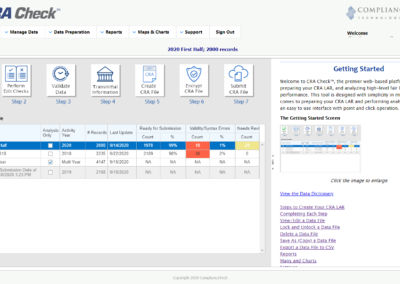

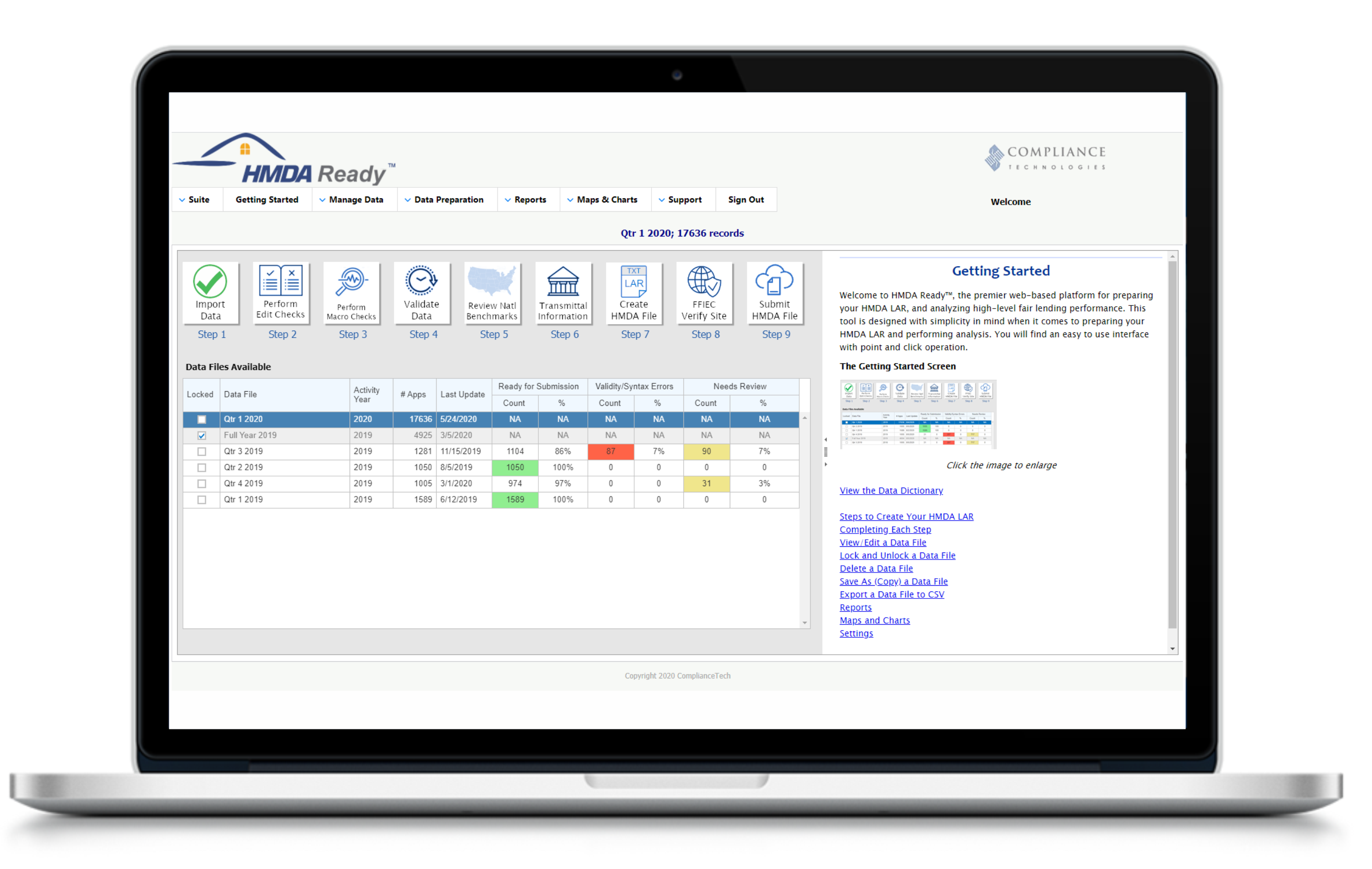

Step-by-Step guided process mirrors the CRA data creation process

- Fully integrated with other ComplianceTech tools, (Fair Lending Magic™, Lending Patterns™, HMDA Ready™, and CRA Check™)

- Free upgrade for existing LP or FLM customers

Includes standard and peer- based core reports

2. Generate submission-ready loan application register databases from scratch using our spreadsheet template or via import from a loan origination system or other vendors’ application

On-screen access CRA guidance

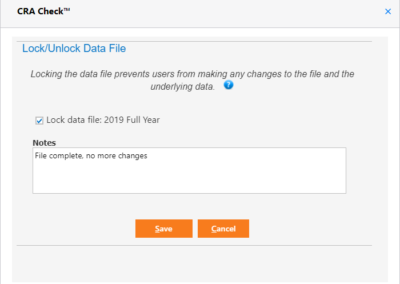

2. Allows limited access for others to help prepare the CRA data for submission

3. Delegate tasks to other members of your team through administrator permissions