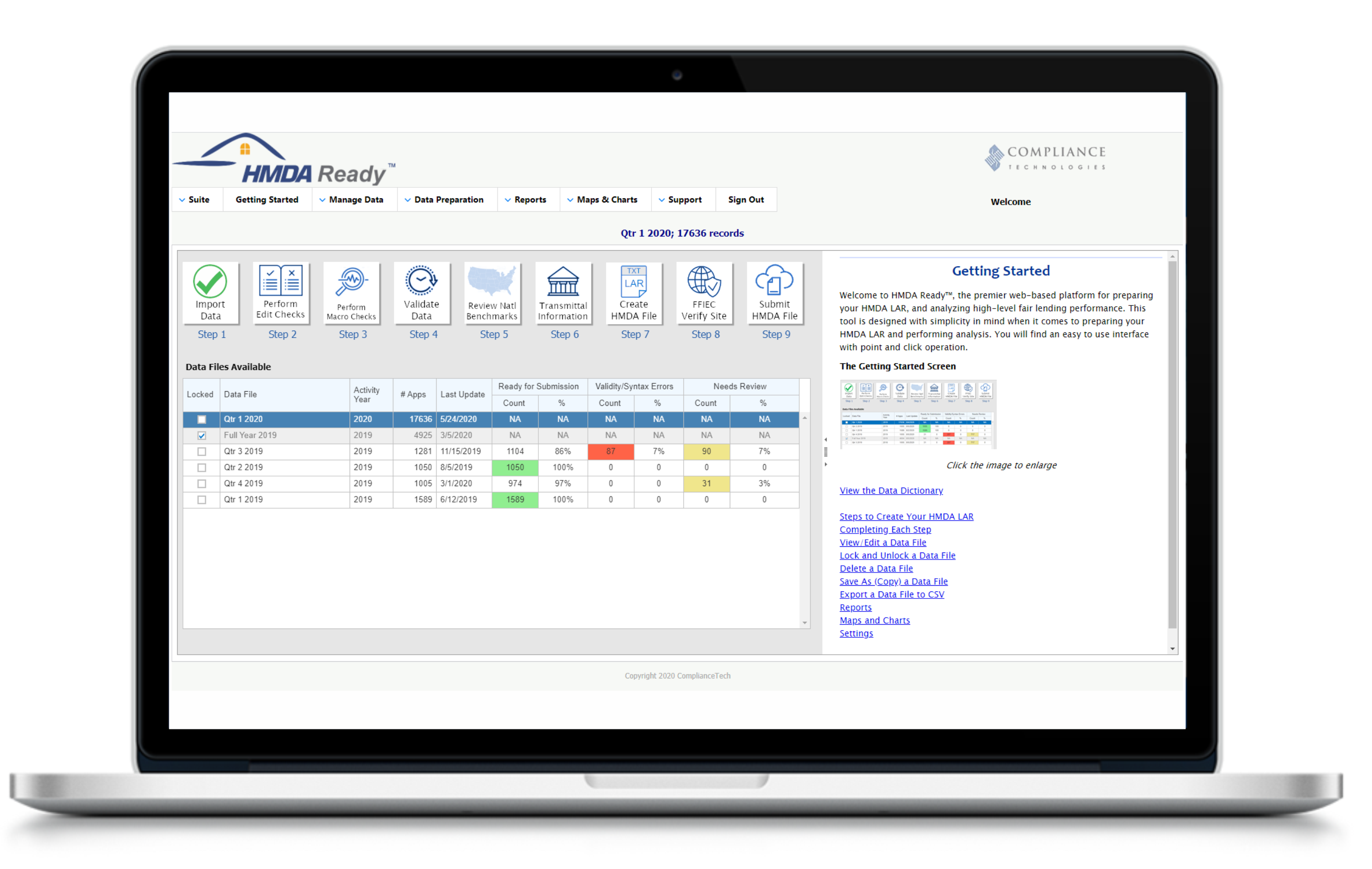

For mortgage lenders who want to have confidence in their HMDA loan / application register (LAR) submission

What can HMDA Ready™ do for you?

What HMDA Ready™ does for you

- Avoid civil monetary penalties, costly resubmission expenses.

- Mitigate Compliance Management System (CMS) Risk by building a better HMDA data foundation.

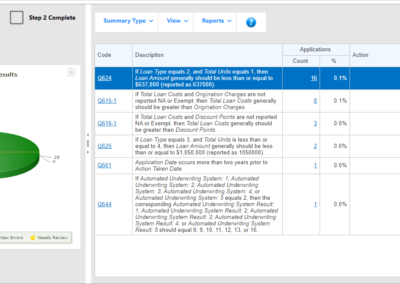

- Identifies hidden data quality problems undetected by edit check.

- Establishes the foundation for accurate and effective fair lending monitoring.

- Critical for a superior fair lending examination experience by your federal or state examining authority.

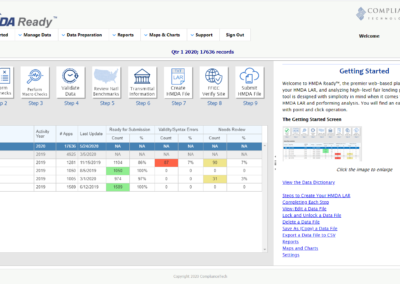

Step-by-Step guided process

- Fully integrated with other ComplianceTech tools, (Fair Lending Magic™, Lending Patterns™, HMDA Ready™, and CRA Check™)

- Discover data quality problems that could negatively affect your compliance

- Capture more data for a complete view of your business

- Easy-to-use templates make it easier to validate data

- Generate reports to track compliance, helping you avoid penalties and resubmission fees

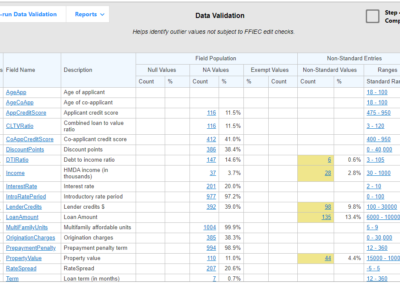

- Data validation that helps identify outlier values not subject to FFIEC edit checks

- Generate submission-ready reports for federal and state authorities

Data Validation, Reports and Features

- Better data quality improves managerial decision-making

- Generate submission-ready loan application register databases from scratch using our spreadsheet template or via import from a loan origination system or other vendors’ application.

- On-screen HMDA Guidance

- User Permissions

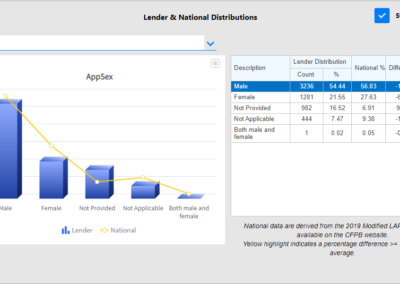

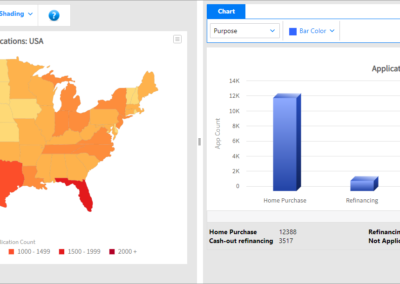

- Compare your HMDA data with national HMDA benchmarks prior to submission

- Verify addresses for current year submission and prior years in seconds