Compliance with the Community Reinvestment Act (CRA) is essential for financial institutions that want to remain in good standing with regulators and the communities they serve. The CRA requires banks and other lenders to meet the credit needs of the communities in which they operate, particularly in low- and moderate-income areas. One important aspect of CRA compliance is the submission and analysis of data to assess a lender’s performance. CRA reporters and non-reporters need a powerful tool that can help lenders comply with these requirements.

Submitting and analyzing CRA data can be a complex and time-consuming process. Lenders are required to collect and report data on their lending activities, including the number and dollar amount of loans made to borrowers in different income and demographic groups, as well as data on their branch locations. This data is then analyzed to determine a lender’s CRA rating, which can have significant implications for its ability to expand and operate in new markets.

If you are looking for a CRA submission and analysis tool, pose the following questions to the vendor:

- Do you have a tool that streamlines the submission and analysis of CRA data?

- Does the platform allow users to input data into an easy-to-use dashboard, providing instant feedback on a lender’s performance?

- Does the platform allow users to gauge performance based on core reports, Performance Tables, and other custom reports based on the CRA’s examination procedures, making it an effective tool for assessing a lender’s CRA rating? These reports can help to demonstrate compliance to regulators. And they should also be useful for internal purposes, in helping banks identify areas for improvement in their lending activities.

- Do you have the ability to analyze data in real-time? Lenders should be able to quickly identify any areas of their lending activities that may be falling short of CRA requirements. For example, if a lender is not meeting its lending targets in low- or moderate-income areas, can the platform identify this issue and provide guidance on how to address it?

- Is the software customizable; can it be tailored to meet your specific needs?

- Is the platform configured to analyze data for different types of lending activities, such as residential mortgages, small business loans, and community development projects? This flexibility allows lenders to focus on the areas of their lending activities that are most important for CRA compliance.

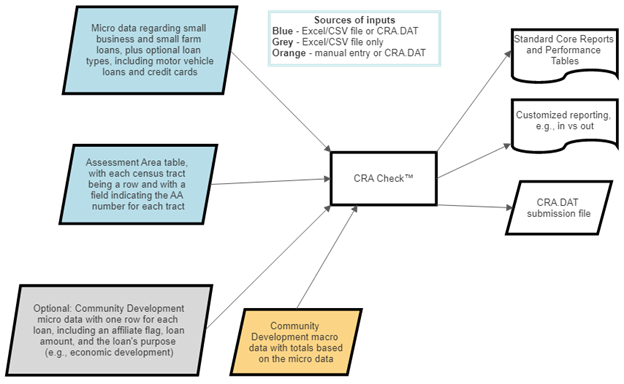

ComplianceTech’s CRA Check™ is a powerful tool that can help lenders comply with CRA submission and analysis requirements. The platform streamlines the data submission process, provides real-time analysis of performance, generates detailed reports, and is highly customizable to meet the specific needs of different lenders. With the CRA Check platform, lenders can more effectively meet their CRA obligations and continue to serve the communities in which they operate.

Visit the the ComplianceTech website today to learn more about CRA Check™ and to schedule a demo.

Recent Comments